Coda Octopus Group (CODA)·FY 2025 Earnings Summary

Coda Octopus Posts 31% Revenue Surge, Stock Jumps 6% on Defense Momentum

January 29, 2026 · by Fintool AI Agent

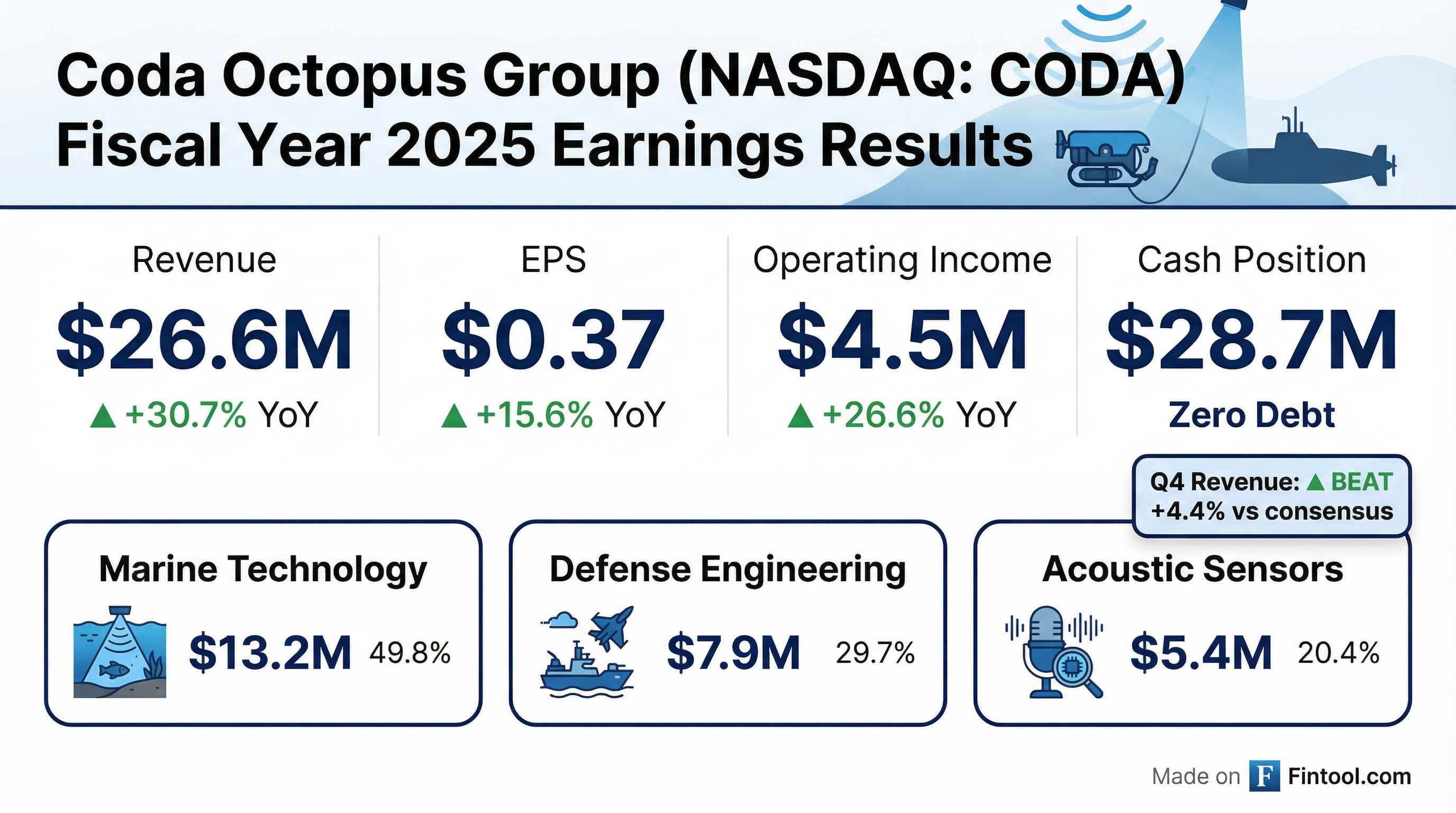

Coda Octopus (NASDAQ: CODA) delivered FY 2025 results that exceeded expectations, reporting revenue of $26.6 million (+31% YoY) and EPS of $0.37 (+16% YoY). The stock is trading up approximately 6% following the earnings call, as investors responded positively to defense sector momentum, the successful NanoGen series launch, and a milestone European navy order for the DAVD untethered system.

Did Coda Octopus Beat Earnings?

Yes — Q4 revenue beat consensus by 4.4%. CODA reported Q4 revenue of $7.06M versus analyst estimates of $6.76M. For the full fiscal year, key metrics showed strong improvement:

*Values retrieved from S&P Global

The 330 basis point decline in gross margin was attributed to the addition of the lower-margin Acoustic Sensors and Materials business (58.6% gross margin vs. 74.5% for Marine Technology), as well as a shift from higher-margin rental sales to hardware sales.

How Did the Stock React?

CODA shares opened at $11.37 and are currently trading around $10.52, up 6.2% from the prior close of $9.91. The stock has beaten revenue consensus in 6 of the last 8 quarters. The company's 52-week range spans $5.76 to $12.22, with shares currently sitting above both the 50-day moving average ($9.45) and 200-day moving average ($8.26).

What Changed From Last Quarter?

Several key developments emerged in FY 2025:

1. European Navy Breakthrough — CODA delivered its first untethered DAVD systems to a "very influential European navy," which management described as a potential catalyst for broader adoption across allied navies. Training is scheduled for Q2 FY 2026, with procurement opportunities expected in Q3-Q4.

2. NanoGen Series Launch — The company introduced its next-generation ultra-compact 3D sonar line, specifically designed for AI-enabled autonomous underwater vehicles. "NanoGen Series is aligned with the strongest growth drivers in the subsea market: autonomy, edge AI, reduced operational costs, and scalable deployment," noted President Blair Cunningham.

3. Defense Mix Shift — Defense sector revenue rose to 46% of Marine Technology sales (up from ~40% in FY 2024), reflecting the company's strategic pivot toward military applications.

4. Approved Navy Use Progress — The DAVD untethered system is undergoing final U.S. Navy authorization (ANU) approval, expected by end of Q2 FY 2026, which would unlock broader procurement.

What Did Management Guide?

Management did not provide explicit numerical guidance but offered directional commentary:

- DAVD Revenue: Expects to exceed FY 2025's $3.7M, though timing will be "lumpy" and back-ended to Q3/Q4 pending ANU approval and budget allocations.

- Defense Procurement: Anticipates procurement decisions for active NanoGen opportunities in early 2026, with initial deliveries commencing within FY 2026.

- M&A Strategy: Actively pursuing acquisitions to deploy the $28.7M cash position, with management "very keen to close another acquisition in fiscal year 2026."

- Rental Recovery: Q4 saw a "significant uptick" in rental opportunities after three quarters of weakness due to offshore renewables project shelving.

Revenue Segment Breakdown

The Precision Acoustics acquisition (completed October 2024) added 20.4% to consolidated revenue and positions the group to compete for larger defense contracts in underwater acoustics.

Within Marine Technology:

- Hardware sales surged 30.5% to $9.5M (from $7.2M)

- Echoscope products represented 71.9% of segment revenue

- DAVD systems contributed 28.1% ($3.7M)

- Asia sales grew 7.7% to $5.9M

Key Management Quotes

On Defense Strategy:

"To achieve the growth that shareholders want to see from our company, we have to increase our market share for underwater imaging sensors in the defense space... The Echoscope's uniqueness of being a single sensor for multiple undersea activities presents a significant advantage over other technologies." — CEO Annmarie Gayle

On AI-Enabled Autonomy:

"The defense subsea market is moving away from large bespoke platforms towards smaller, networked, and increasingly autonomous vehicles that can be deployed at scale. This transition favors technologies that maximize performance per unit cost and enable rapid production." — President Blair Cunningham

On European Expansion:

"This delivery to this European Navy is really a pivotal moment for the technology, because this is really a trendsetter navy in Europe." — CEO Annmarie Gayle

What Are the Key Risks?

-

Budget Uncertainty: Defense revenue depends on Congressional appropriations. Programs are currently funded by continuing resolutions, limiting visibility into FY 2026 budgets.

-

Concentration Risk: Success hinges heavily on ANU approval for DAVD and procurement decisions for NanoGen from a handful of defense programs.

-

Offshore Wind Headwinds: The commercial rental business was "significantly underutilized" due to U.S. policy changes affecting offshore renewables, causing projects to be shelved by Shell, Orsted, and BP.

-

Limited Analyst Coverage: As a ~$118M market cap company, CODA has minimal Wall Street coverage, which can create volatility and liquidity challenges.

Q&A Highlights

On Indian Navy Opportunity: When asked about deliveries to the Indian Navy, CEO Gayle expressed uncertainty about the source of that information, suggesting no material engagement currently exists.

On European Navy Pipeline: Management confirmed delivering 2 DAVD systems to a European navy, with training planned for Q2 and potential follow-on orders in Q3-Q4. The customer is described as "incredibly well connected to all of the neighboring navies" — suggesting potential for cascading adoption.

On NanoGen Integration: Rather than waiting for new vehicle programs (longer gestation), CODA is pursuing "PIP" (Platform Improvement Programs) to integrate NanoGen into existing fielded defense platforms — a faster path to revenue.

Forward Catalysts

Bottom Line

Coda Octopus delivered a strong FY 2025 with 31% revenue growth and meaningful strategic progress on its defense pivot. The company enters FY 2026 with clear catalysts — ANU approval, European expansion, and NanoGen program awards — but execution risk remains elevated given budget uncertainty and the binary nature of key procurement decisions. With $28.7M in cash, zero debt, and management's stated M&A ambitions, capital allocation will be a key focus area for investors in the coming quarters.

Read the full earnings transcript for additional details.